Pension Late Payment Contribution Policy

Pension Plan Status

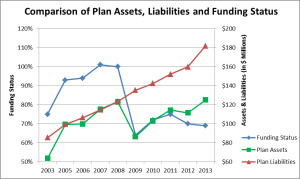

Like most investments, the Plan trust experienced significant losses during the market downturn of 2008-09. Although trust assets have rebounded they have not kept pace with benefits liability growth. The Plan continues to face two significant ongoing challenges: aging participant demographics and an uncertain global economy with volatile financial markets.

One of the most important benchmarks to evaluate the financial well-being of the Plan is its “funding status.” The funding status compares the present value of benefits earned by participants (i.e. “liabilities”) to the Plan’s current assets. The chart below shows that liabilities continue to rise at an increasing rate and the 2008-09 downturn caused a gap between assets and liabilities that recent investment gains and contribution increases have not been able to close.

(click the chart to enlarge)

Changes in 2014

In light of these circumstances, the WELS Pension Commission (the “Commission”) has taken several actions to improve the Plan’s funding status and maintain its long-term viability:

- The Commission continues to invest Plan assets in funds with low volatility to protect against future market downturns.

- The basis schedule on which Plan benefits are calculated for new retirees will remain flat for retirement dates through June 30, 2014 to slow the increase in liabilities.

- Plan contribution rates effective January 1, 2016 will increase to $3,120 (+11.4%) for a full-time worker in 2016.

- Contributions not made on time are subject to a late payment penalty.

The late payment penalty has been established to reflect the Plan’s lost investment earnings when payments are not made timely, which ultimately spreads additional costs to the organizations that pay contributions on a timely basis. To ensure that your organization in not assessed a penalty, we are providing a new Automated Clearing House payment program, under which the full amount due for each quarterly invoice will be automatically deducted from your organization’s bank account on the first business day of each quarter. Details regarding this program and the late payment penalty are available by clicking this link.

In this way, all parties are walking together and sharing in the funding needed to reinforce the Plan. This funding will be essential to pay the meaningful benefits promised to current retirees and earned by active workers. Your continued support of the Plan during these challenging times is greatly appreciated.

If you have questions regarding the Plan, please feel free to contact the WELS Benefit Plans Office by e-mail to [email protected] or by calling 414-256-3860. Questions specifically regarding the late payment penalty should be directed to the WELS Benefits Service Center by e-mail to [email protected] or by calling 1-800-487-8322 (option 1).